Reversal of Impairment Loss

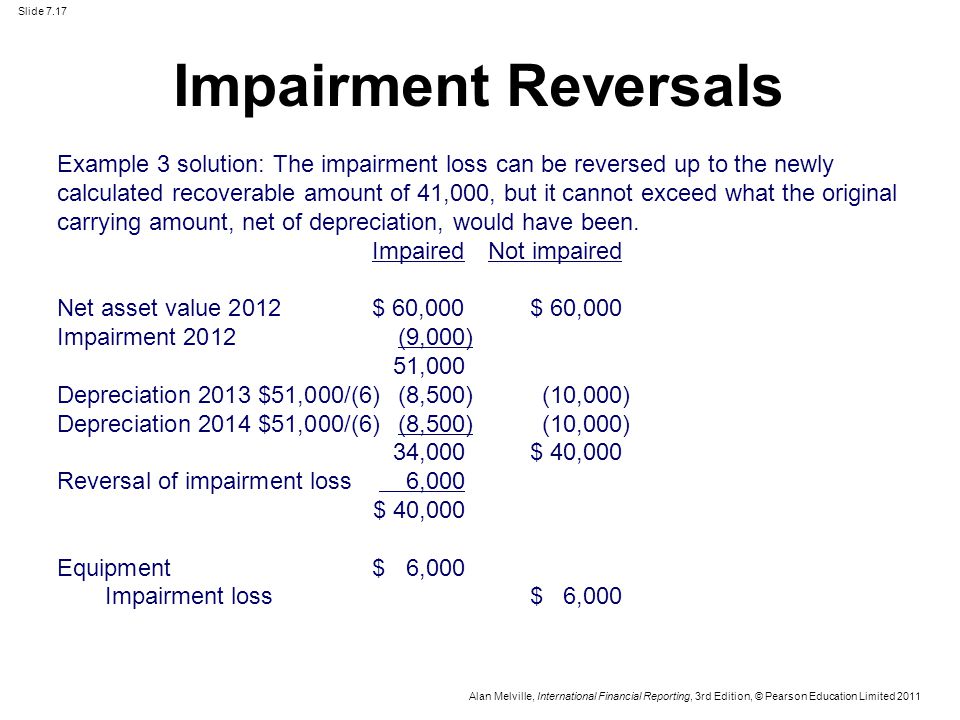

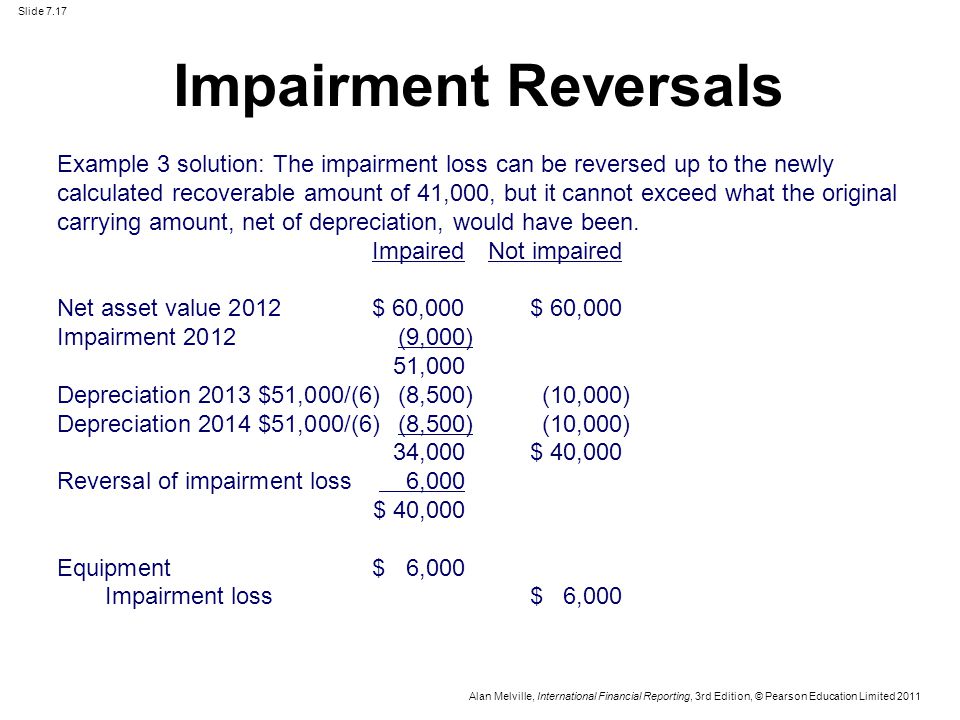

123 In allocating a reversal of an impairment loss for a cash-generating unit in accordance with paragraph 122 the carrying amount of an asset shall not be increased above the. The impairment loss should be reversed but only to the extent that it does not exceed the carrying amount that would have been determined had no impairment loss been recognised.

Reversal Of Impairment Losses Annual Reporting

Reversal of impairment losses.

. Reversal of impairment is a situation where a company can declare an asset to be valuable where it has previously been declared a liability. The term reversal for concerning the loss of impairment is taken to be recognised in form of losses or profits unless there are existent any relation with that of re. This assignment on reversal of impairment loss of goodwill.

A reversal of an impairment loss reflects an increase in the estimated service potential of an asset either from use or sale since the date when an enterprise last recognised. Assess at each balance sheet date whether there is an indication that an impairment loss. The technical definition of the impairment loss is a decrease in net carrying value the acquisition cost minus depreciation of an asset that is.

It means that you cannot reverse. Reversal of an impairment loss Same approach as for the identification of impaired assets. Reversal of Impairment Loss.

Consistent with other IFRS impairment guidance IFRS 15 requires impairment losses to be reversed in certain circumstances similar to the existing standard on impairment of assets. T compares the recoverable amount and the net carrying amount of the Country A cash-generating unit. In these circumstances the entity may need to record a gain arising from the reversal of previous impairment losses but with the following conditions.

This treatment is applicable on following types of fixed assets. Rather any expected recoveries in future cash flows. The testing of the impairment of assets the profits cash flows and other benefits which are associa.

Cr Profit or Loss Account 900. Reversals of impairment losses for debt securities classified as available-for-sale or held-to-maturity securities are prohibited. You can reverse an impairment loss only when there is a change in the estimates used to determine the assets recoverable amount.

There is a third possibility where an asset has previously been revalued 1200 and the impairment was say 700. In general asset impairment. Recoverable amount is more than the historical net book value.

Impairment loss Carrying. The impairment loss to be reversed is calculated as follows. 4 rows To reverse an impairment loss the estimated service potential of the asset or CGU either.

It is calculated by the following simple formula. Calculation of the carrying. Understanding Impairment Loss.

Impairment Loss Reversal Historical Net Book Value - Net.

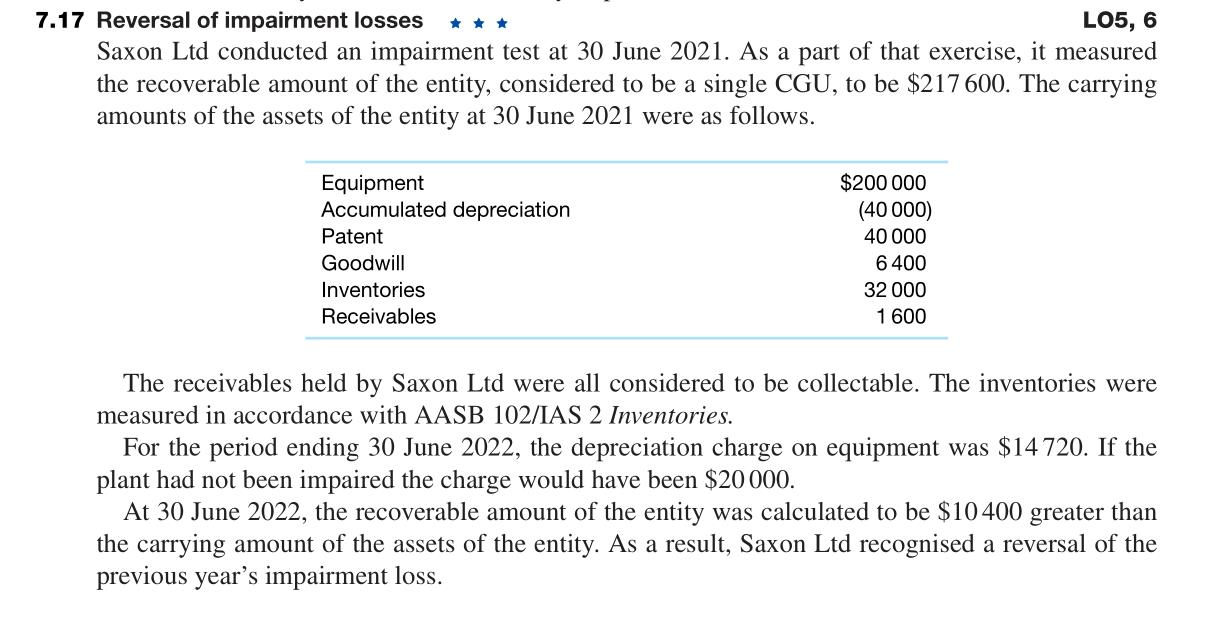

Solved 7 17 Reversal Of Impairment Losses Lo5 6 Saxon Chegg Com

Chapter 7 Impairment Of Assets Ias36 Ppt Video Online Download

Ias 36 Example Of The Reversal Of Impairment Youtube

Accounting For Property Plant And Equipment Reversal Of Impairment Loss Part 1 Youtube

0 Response to "Reversal of Impairment Loss"

Post a Comment